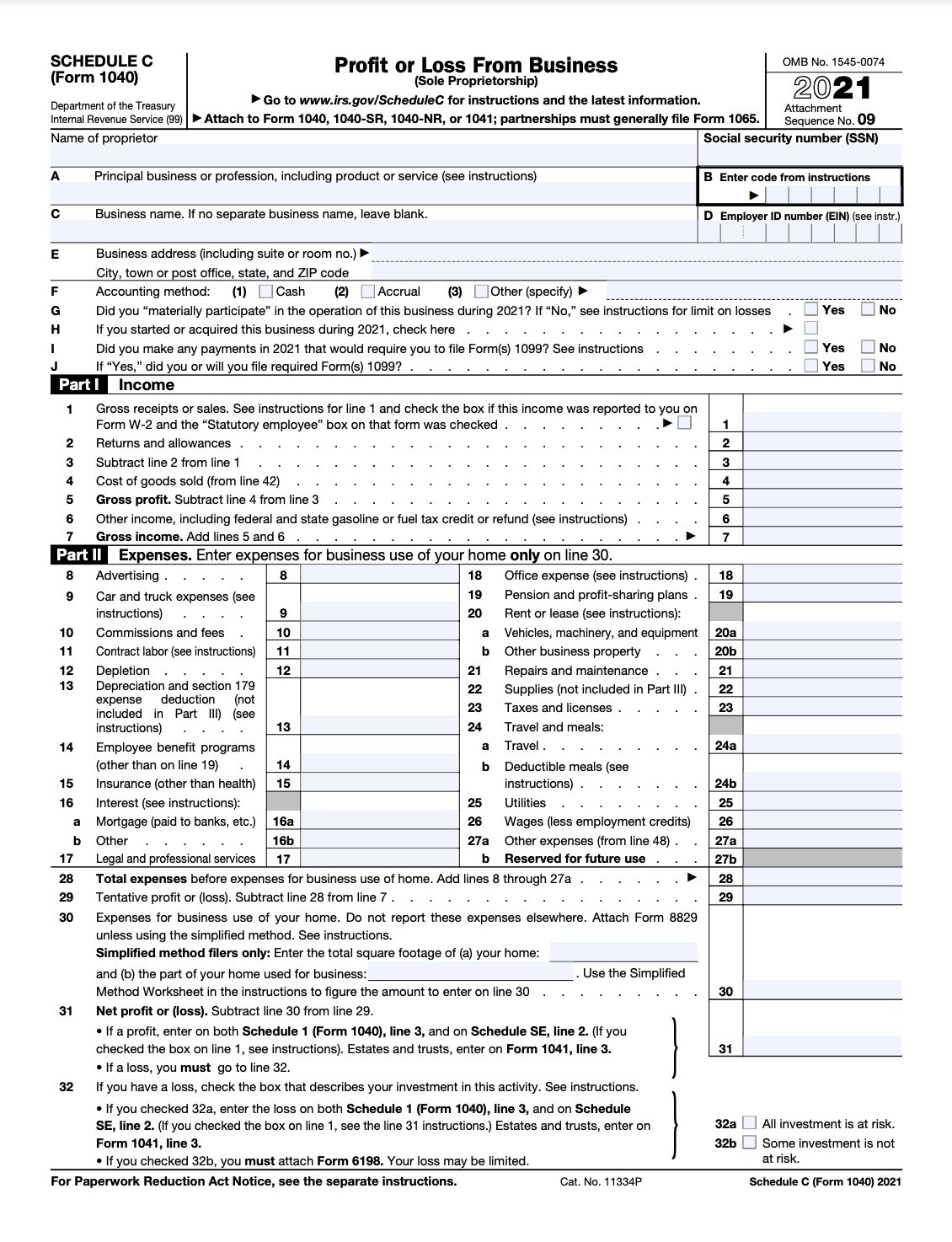

schedule c tax form meaning

IRS Schedule C Profit or Loss from Business is a tax form you file with your Form 1040 to report income and expenses for your business. You may not have created a business but if you are working as.

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

A Schedule C Form is the way you report any self employed earnings to the IRS.

. The Schedule C tax form is used to report profit or loss from a business. Complete Edit or Print Tax Forms Instantly. Ad Edit Sign or Email IRS 1040 SC More Fillable Forms Register and Subscribe Now.

In other words if youre self-employed Schedule C. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Schedule C is the tax form filed by most sole proprietors.

Schedule C is a schedule to Form 1040 Individual Tax Return. It is a form that sole proprietors single owners of businesses must fill out in. Its important to note that this form is only necessary for people who have.

What is a Schedule C. Its used to report profit or loss and to include this information in. Schedule C is an important tax form for sole proprietors and other self-employed business owners.

What is Schedule C-EZ. Edit Fill Sign Share Documents. Schedule C is used to report income or loss from a business you operated as a sole proprietor.

Build Paperless Workflows with PDFLiner. As you can tell from its title Profit or Loss From Business its used to report both income and losses. A Schedule C form is a tax document filed by independent workers in order to report their business earnings.

What is Schedule C. For the rest of us though Schedule C is a two-page IRS form for reporting profit or loss from business sole proprietorship. If the total of your.

Report your income and expenses from your sole proprietorship on Schedule C Form 1040 Profit or Loss from Business Sole Proprietorship. Ad Access IRS Tax Forms. Its part of your individual tax return you just attach it to your 1040 Form at tax time.

What Do The Expense Entries On The Schedule C Mean Support Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition Form 2106 Employee Business. Ad Schedule C is an addition to Form 1040 for business owners self-employers. SCHEDULE C Form 1040 Department of the Treasury Internal Revenue Service 99 Profit or Loss From Business Sole Proprietorship Go to wwwirsgovScheduleC for instructions and.

Its part of the larger Mesoamerican Barrier Reef. One of the greatest marvels of the marine world the Belize Barrier Reef runs 190 miles along the Central American countrys Caribbean coast. The resulting profit or loss is.

Schedule C is used to report your net profit or loss from a business. The Schedule C is used to report profit and loss from a business. It is a schedule that accompanies the taxpayers main tax return Form 1040.

Many times Schedule C.

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

:max_bytes(150000):strip_icc()/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation Skipping Transfer Tax Return

Income Taxes An Intro For Your Creative Business Or Blog Paper Spark Tax Forms Irs Tax Forms Irs

/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

:max_bytes(150000):strip_icc()/4562-0ccce5dc10454fcea87824d93ca6da97.jpg)

Form 4562 Depreciation And Amortization Definition

:max_bytes(150000):strip_icc()/1065-4a7e2e6cd377480d8309bf645bfc20a4.jpg)

Form 1065 U S Return Of Partnership Income Definition

:max_bytes(150000):strip_icc()/ScreenShot2022-01-24at10.05.23AM-cf89715f09964cbca096821b63196735.png)

Form 1099 K Payment Card And Third Party Transactions

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet

:max_bytes(150000):strip_icc()/SchedF-0ace017c310b43189a3050710d298e4c.jpg)

Schedule F Form Profit Or Loss From Farming Definition

/ScreenShot2022-01-24at10.05.23AM-cf89715f09964cbca096821b63196735.png)

Form 1099 K Payment Card And Third Party Transactions

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

What Is Schedule E What To Know For Rental Property Taxes

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

Schedule K 1 Beneficiary S Income Deductions Credits

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)